Time series statistics

Library of often used functions for evaluating properties of time series or

data arrays. See also Normalization.

correl(vars Data, int Length, function): var

Spearman correlation of the Data series with an arbitrary

function. Used for the CTI,

CCYI, and CCYIR indicators. Source in

indicators.c; usage and description on

Financial Hacker.

Correlation(vars Data1, vars Data2, int TimePeriod): var

Pearson's correlation coefficient between two data series over the given

TimePeriod, in the range between -1..+1. A coefficient

of +1.0, a "perfect positive correlation," means that changes in

Data2 cause identical changes in Data1 (e.g.,

a change in the indicator will result in an identical change in the asset price).

A coefficient of -1.0, a "perfect negative correlation," means that changes

in Data2 cause identical changes in Data1, but

in the opposite direction. A coefficient of zero means there is no relationship

between the two series and that a change in Data2 will have no

effect on Data1. This function can be also used to get the autocorrelation

of a series by calculating the correlation coefficient between the original series

and the same series lagged by one or two bars (series+1 or

series+2).

Covariance(vars Data1, vars Data2, int TimePeriod): var

Covariance between two data series. Can be used to generate a covariance matrix

f.i. for the markowitz efficient frontier calculation.

Fisher(vars Data): var

Fisher Transform; transforms a normalized Data series to a normal

distributed range. The return value has no theoretical limit, but most values are

between -1 .. +1. All Data values must be in the

-1 .. +1 range, f.i. by normalizing with the AGC,

Normalize, or cdf function. The minimum

Data length is 1; a single var

can be passed with the & operator, f.i.

Fisher(&MyVariable). Source in

indicators.c.

FisherInv(vars Data): var

Inverse Fisher Transform; compresses the Data series to be between

-1 and +1. The minimum length of the Data

series is 1; a single var can be passed with

the & operator, f.i. FisherInv(&MyVariable). Source

in indicators.c.

FisherN(vars Data, int TimePeriod): var

Fisher Transform with normalizing; normalizes the Data series with

the given TimePeriod and then transforms it to a normal distributed

range. Similar to a Normalize filter (see below), but more selective

due to the normal distribution of the output. The return value has no theoretical

limit, but most values are in the -1.5 .. +1.5 range. The minimum

length of the Data series is equal to TimePeriod.

The function internally creates series (see remarks). Source code in indicators.c.

FractalDimension(vars Data, int TimePeriod): var

Fractal dimension of the Data series; normally 1..2.

Smaller values mean more 'jaggies'. Can be used to detect the current market regime

or to adapt moving averages to the fluctuations of a price series. Requires a lookback

period of twice the TimePeriod. Source in indicators.c.

Gauss(vars Data, int TimePeriod): var

Gauss Filter, returns a weighted average of the data within the given time period,

with the weight curve equal to the Gauss Normal Distribution. Useful for removing

noise by smoothing raw data. The minimum length of the Data series

is equal to TimePeriod, the lag is half the TimePeriod.

Source in indicators.c.

Hurst (vars Data, int TimePeriod): var

Hurst exponent of the Data series; between 0..1.

The Hurst exponent measures the 'memory' of a series. It quantifies the autocorrelation,

i.e. the tendency either to revert to the mean (Hurst < 0.5)

or to continue trending in a direction (Hurst > 0.5). This way

the Hurst exponent can detect if the market is in a trending state. The

TimePeriod window (minimum 20) must have sufficient length

to catch the long-term trend; the lookback period must be at least twice the TimePeriod.

The function internally creates series (see remarks). Source in indicators.c.LinearReg(vars Data, int TimePeriod): var

Linear Regression, also known as the "least squares moving average"

(LSMA). Linear Regression attempts to fit a straight trendline between several

data points in such a way that the distance between each data point and the trendline

is minimized. For each point, the straight line over the specified previous bar

period is determined in terms of y = b + m*x, where y

is the price and x the bar number starting at

TimePeriod bars ago. The formula for calculating b and

m is then

m = (nΣxy - ΣxΣy) / (nΣx² - (Σx)²)

b = (Σy - bΣx)

/ n

where n is the number of data points (TimePeriod)

and Σ is the summation operator. The LinearReg function returns b+m*(TimePeriod-1),

i.e. the y of the current bar.

Source

in ta-lib.zip. For higher order regression or for evaluating

the regression value at past or future bars, use polyfit / polynom. For logistic

regression with multiple variables, use the advise(PERCEPTRON,...).

LinearRegAngle(vars Data, int TimePeriod): var

Linear Regression Angle. Returns m converted

to degrees. Source in ta-lib.zip. Due to the arbitrary x and y units of a price chart, the angle

is a mostly useless parameter, although held in high esteem by Gann believers.

LinearRegIntercept(vars Data, int TimePeriod): var

Linear Regression Intercept. Returns b.

Source in ta-lib.zip.

LinearRegSlope(vars Data, int TimePeriod): var

Linear Regression Slope. Returns m as data difference per bar. Source

in ta-lib.zip.

MatchIndex(vars Data, var Reference, int Period): int

Index of the Data value

closest to Reference over the specified Period. 0 =

best match is at current bar, 1 = at one bar ago, and so on. If the

Data series

was shifted (+N), add the offset N to

the returned index for getting the number of bars passed since the best match.

Source in indicators.c.

MaxIndex(vars Data, int Period): int

Index of highest Data value over the specified Period.. 0 = highest value

is at current bar, 1 = at one bar ago, and so on. If the series

was shifted (+N), add the offset N to

the returned index for getting the number of bars passed since the lowest

Data value. Source in

ta-lib.zip.

MaxVal(vars Data, int Period): var

Highest Data value over the specified Period.

Source in ta-lib.zip.

Median(vars Data, int Period): var

Median Filter; sorts the elements of the Data series and returns

their middle value within the given Period. Useful for removing noise spikes

by eliminating extreme values. The minimum length of the Data series

is equal to Period, the lag is half the Period.

Source in ta-lib.zip. See also Percentile.

MinIndex(vars Data, int Period): int

Index of the lowest value over a specified period; 0 = lowest value

is at current bar, 1 = at one bar ago, and so on. If the series

was shifted (+N), add the offset N to

the returned index for getting the number of bars passed since the lowest

Data value.

Source in ta-lib.zip. MinVal(vars Data, int Period): var

Lowest value over a specified period. Source

in ta-lib.zip.

MinMax(vars Data, int Period): var

Lowest and highest values over a specified period. Result in rMin, rMax.

Source in ta-lib.zip.

MinMaxIndex(vars Data, int Period): int

Indexes of lowest and highest values over a specified period. Result in rMinIdx,

rMaxIdx. 0 = current bar, 1 = one bar ago,

and so on. Source in ta-lib.zip.

Mode(vars Data, int TimePeriod, int Steps): var

Most frequent Data value within TimePeriod. For

this the Data range is divided into Steps separate

ranges, and the number of values that fall into a range is counted. The function

returns the value with the highest count.

Source in indicators.c.

Moment(vars Data, int TimePeriod, int N): var

The statistical moment N (1..4) of the

Data series section given by TimePeriod. The first moment

is the mean, second is variance, third is skewness, fourth ist kurtosis.

The standard deviation is the square root of the second moment. The mean is

stored in rMean. See also SemiMoment. Source

in indicators.c.NumAbove(vars Data, int Length, var Theshold): var

Number of Data elements above the given

Threshold within the Length, from

0 to Length. Source in indicators.c.

NumInRange(vars Low, vars High, var Min, var Max, int Length): var

Number of data ranges, given by their Low and

High values, that lie completely inside the interval from

Min to Max within the given Length.

Can be used to calculate the distribution of prices or candles. Low

and High can be set to the same value for counting

all values in the interval, or swapped for counting all candles that touch the interval.

Returns a value of 1..Length. Source in indicators.c.

See also PercentRank.

NumRiseFall(vars Data, int TimePeriod): var

Length of the last streak of rising or falling values in the Data

series, back to the given TimePeriod. For a rising sequence its

length is returned, for a falling sequence the negative length (f.i. -3

when Data[3] < Data[2] > Data[1] > Data[0]). Range:

1..TimePeriod-1. See the RandomWalk

script for an example. Source in indicators.c.

NumUp(vars Data, int TimePeriod, var Theshold): var

NumDn(vars Data, int TimePeriod, var Theshold): var

Number of upwards or downwards Data changes by more than the given

Threshold within the TimePeriod, from

0 to TimePeriod-1. See also SumUp,

SumDn. Source in indicators.c.

Percentile(vars Data, int Length, var Percent): var

Returns the given percentile of the Data series with given

Length; f.i. Percent = 95 returns the

Data value that is above 95% of all other values. Percent = 50

returns the Median of the Data series.

PercentRank(vars Data, int Length, var Value): var

The opposite of Percentile: Returns the percentage of Data

values within the given Length that are smaller or equal than the

given Value; returns 100 when Value is the greatest

in the data range. Can transform any series to a range of 0..100. See also

NumInRange.

R2(vars Data, int Length): var

Coefficient of determination (+1...-1); similarity of the Data

series with a straight line through its end points. At 1 the

data series is equivalent to a straight line, at 0 or below

even the mean of the data is a better fit to the straight line than the real

data series.

SemiMoment(vars Data, int TimePeriod, int N): var

The statistical moment N (1..4) of the

Data series section given by TimePeriod, using only

data points at or below the mean. The first moment

is the mean, the second is the semivariance, third is downside skew, and fourth is

downside kurtosis.

The mean is stored in rMean. The semideviation

(downside deviation) is the square root of the semivariance, and is often

considered a better measure of risk than the standard deviation. See also

Moment. Source in indicators.c.

ShannonGain(vars Data, int TimePeriod): var

Expected logarithmic gain rate of the Data series in the range

of about +/-0.0005. The gain rate is derived from the Shannon probability

P = (1 + Mean(Gain) / RootMeanSquare(Gain)) / 2, which is the likeliness

of a rise or fall of a high entropy data series in the next bar period. A positive

gain rate indicates that the series is more likely to rise, a negative gain rate

indicates that it is more likely to fall. The zero crossover could be used for a

trade signal. Algorithm by John Conover. Source in

indicators.c.

ShannonEntropy(vars Data, int Length, int PatternSize): var

Entropy of patterns in the Data series, in bit; can be used to

determine the 'randomness' of the data. PatternSize (2..8) determines

the partitioning of the data into patterns of up to 8 bit. Each Data

value is either higher than the previous value, or it is not; this is a binary information

and constitutes one bit of the pattern. The more random the patterns are distributed,

the higher is the Shannon entropy. Totally random data has a Shannon entropy identical

to the pattern size. Algorithm explained on the

Financial Hacker blog; source in indicators.c.

Spearman(vars Data, int TimePeriod): var

Spearman's rank correlation coefficient; correlation between the original

Data series and the same series sorted in ascending order within

TimePeriod (1..256). Returns the similarity to

a steadily rising series and can be used to determine trend intensity and turning

points. Range = -1..+1, lag = TimePeriod/2. For

usage and details, see Stocks & Commodities magazine 2/2011. Source in indicators.c.

StdDev(vars Data, int TimePeriod): var

Standard Deviation of the Data series in the time period, from

the ta-lib; accuracy = 0.0001. For long time

periods, higher accuracy, or for downside deviation, use the square root of the second

Moment or SemiMoment.

Sum(vars Data, int Length): var

Sum of all Data elements up to the given Length.

Source in ta-lib.zip.

SumUp(vars Data, int Length): var

SumDn(vars Data, int Length): var

Sum of all upwards or downwards Data changes up to the given

Length. See also NumUp, NumDn. Source

in indicators.c.

SumSq(vars Data, int Length): var

Sum of the squares of all Data elements up to the given Length.

Source code in indicators.c.

TSF(vars Data, int TimePeriod): var

Time Series Forecast. Returns b + m*(TimePeriod), the Linear Regression

forecast for the next bar.

Variance(vars Data, int TimePeriod): var

Variance of the Data series in the time period, accuracy = 0.0001. Source in

ta-lib.zip. For long time

periods, higher accuracy, or for downside variance, use the second

Moment or SemiMoment.

Standard parameters:

| TimePeriod |

The number of bars for the time period of the function, if any; or

0 for using a default period. |

| Length |

The length of the Data series. |

| Data |

A data series, in reverse time order,

usually derived from

the price functions price(), priceC()

etc.. Alternatively a user created series or any other double float

array with the given minimum length can be used. If not mentioned

otherwise, the minimum length of the Data

series is TimePeriod. Some functions require a second data

series Data2. |

Usage example:

Volatility(Prices,20) calculates the standard volatility of a daily

price series over the last 20 days.

Remarks:

- The TA-Lib function prototypes are defined in include\functions.h.

The C source

code of all included TA-Lib indicators is contained in Source\ta_lib.zip

and can be studied for examining the algorithms. Some TA-Lib indicators that

originally didn't work properly - such as Correlation or SAR - have been replaced

by working versions. The C source code of most additional indicators that are

not part the the TA-Lib is contained in Source\indicators.c.

- TA-Lib indicators can only be used between INITRUN

and EXITRUN, since TA-Lib and series management are released at end of the

session. This restriction does not apply when the

STRAIGHT flag is set.

- TimeFrame affects subsequent data

series and thus also affects all indicators that use

the data series as input. The TimePeriod is then not in Bar

units, but in time frame units. TimeFrame has no effect on

indicators that do not use data series.

Examples:

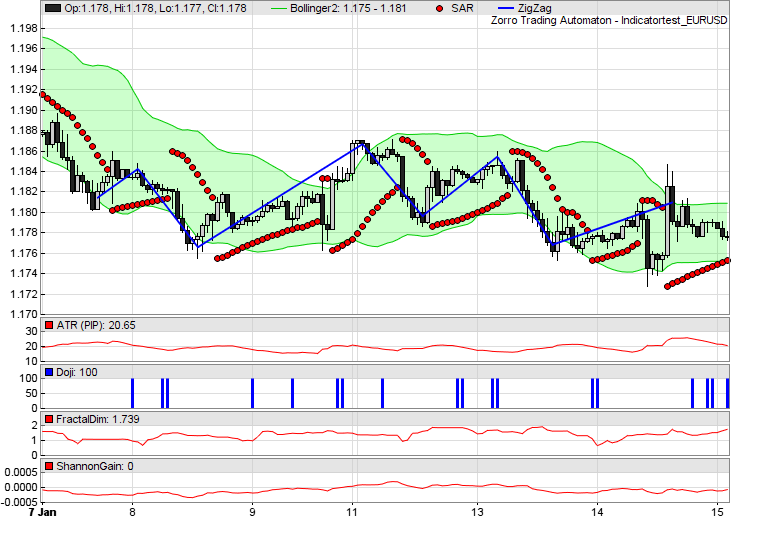

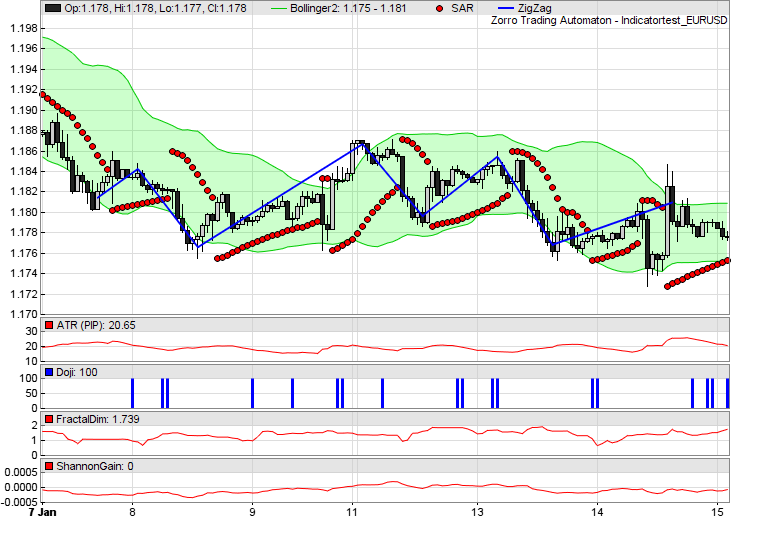

// plot some indicators

function run()

{

set(PLOTNOW);

var* Price = series(price());

// plot Bollinger bands

BBands(Price,30,2,2,MAType_SMA);

plot("Bollinger1",rRealUpperBand,BAND1,0x00CC00);

plot("Bollinger2",rRealLowerBand,BAND2,0xCC00FF00);

plot("SAR",SAR(0.02,0.02,0.2),DOT,RED);

ZigZag(Price,20*PIP,5,BLUE);

// plot some other indicators

plot("ATR (PIP)",ATR(20)/PIP,NEW,RED);

plot("Doji",CDLDoji(),NEW+BARS,BLUE);

plot("FractalDim",FractalDimension(Price,30),NEW,RED);

plot("ShannonGain",ShannonGain(Price,40),NEW,RED);

}

See also:

Spectral filters, indicators,

normalization, candle patterns,

machine learning

►

latest version online