Hedging, Virtual Hedging, FIFO Compliance

Many strategies, such as grid traders or systems with multiple algorithms, often

hold opposite positions of the same asset. This would normally violate the

NFA and FIFO compliance

required by international brokers and cause rejection of orders. Even if orders

are accepted, holding long and short positions simultaneously increases risk, margin,

and trading costs. It is always preferable to close an open position, rather than

opening a new position in opposite direction.

Therefore scripts

must

take care of NFA and FIFO compliant trading, i.e. close first opened positions first,

and avoid concurrent long and short positions. This can require lengthy and awkward

coding when several algorithms trade with the same assets. The

virtual hedging mechanism

of Zorro S guarantees FIFO compliant closing of trades and prevents positions in

opposite directions, even with complex portfolio systems. This happens in a completely

transparent way; the script needs no special code and can arbitrarily open and close

positions.

The virtual hedging mechanism uses two layers of trades,

phantom trades and pool trades. The pool trades

hold the net amount of the phantom trades. The strategy script only handles the

phantom trades, while the broker only receives orders for the pool trades. Pool

trades are opened or closed when phantom trades open or close, but not necessarily

in that order. Phantom trades can be open in both directions at the same time, but

the resulting pool trades are only open in one direction per asset, either short

or long.

Systems with virtual hedging are almost always* superior to

'real hedging' systems that hold opposite positions. Aside from NFA and FIFO compliance, virtual

hedging systems achieve higher profit due to reduced transaction costs, need less

capital due to lower margin requirements, and have lower risk because trades are

closed earlier and less exposed to the market. Some brokers, such as

Oanda, apply virtual hedging automatically to all trades.

For brokers that don't, Zorro can activate virtual hedging with the Hedge

variable (see below). All trades are then entered in phantom

mode. When the net amount - the difference of long and short open lots - changes,

Zorro automatically opens or closes pool trades in a way that FIFO order is observed

and market exposure is minimized.

Example: several long positions are open with a total amount of 100 lots. Now

a short trade of 40 lots is entered. The net amount is now 60 lots (100 long lots

minus 40 short lots). Zorro closes the oldest long pool trades fully or partially

until the sum of open positions is at 60 lots. If partial closing is not supported,

the oldest long pool trades are fully closed until the remaining position is at

or below 60 lots. If it's less than 60 lots, a new long pool trade is opened at

the difference. In both cases the net amount ends up at exactly 60 lots.

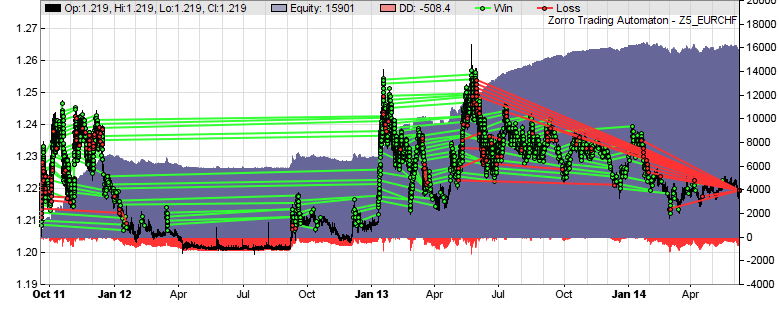

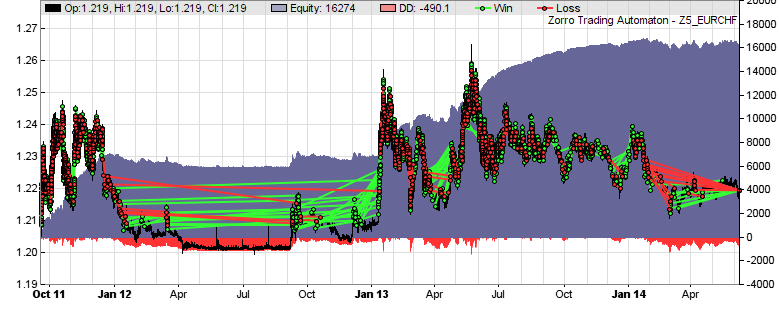

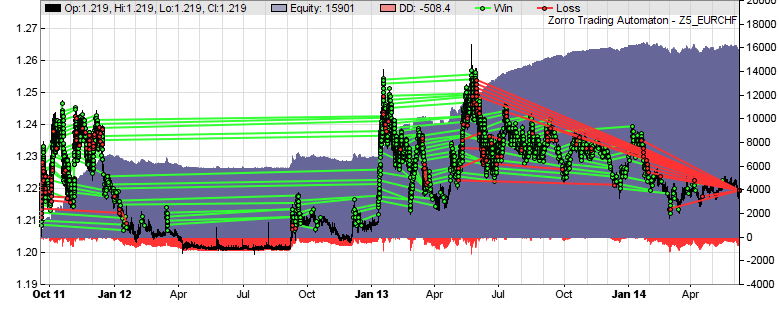

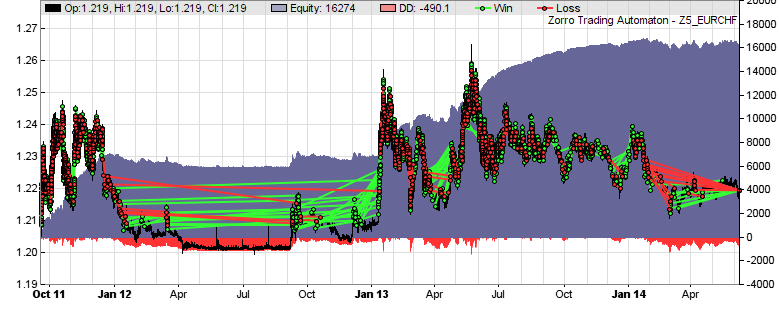

Virtual hedging affects performance parameters.

The equity curves of a system with or without virtual hedging are

rather similar, but the number of trades, the profit factor, the win rate, and the

average trade duration can be very different. Here's an example of the same grid trading

system without and with virtual hedging:

EUR/CHF grid trader, real hedging, 402 trades, avg duration

14 weeks, win rate 95%, profit factor

10, total profit $15900

EUR/CHF grid trader, virtual hedging, 261 trades, avg duration

2 weeks, win rate 65%, profit factor 3,

total profit $16300

* Exception: Systems that exploit rollover / swap arbitrage or use special

order types cannot use virtual hedging.

Hedge

Hedging behavior; determines how simultaneous long and short positions with the

same asset are handled.

Range:

| 0 |

No hedging; automatically closes opposite positions with the same

asset when a new position is opened (NFA compliant;

default for NFA accounts). |

| 1 |

Hedging across algos; automatically closes opposite positions with the

same algo when a new position is opened (not NFA

compliant; default for non-NFA accounts). |

| 2 |

Full hedging; long and short positions even with the same

algo can be open at the same time (not NFA compliant).

Entering a trade will not automatically close opposite positions. |

| 4 |

Virtual hedging without partial closing (NFA compliant). Long and

short positions can be open simultaneously, but only the net position is

open in the broker account. Phantom trades immediately trigger the

opening or closing of corresponding pool positions. |

| 5 |

Virtual hedging with partial closing and pooling (NFA and FIFO

compliant). Phantom trades in

the run function are collected and result in a

single pool trade. Intrabar phantom trades trigger pool trades

immediately. Open pool positions are partially closed to match the net

amount. |

| 6 |

Script-synchronized virtual hedging with partial closing and pooling (NFA and FIFO

compliant). Like Hedge mode 5, but pool trades are only

snychronized when the tradeUpdate function

is called. |

Type:

int

Remarks:

- Virtual hedging requires Zorro S. The performance report and the

Total statistics reflect the pool trades, the

Long/Short statistics reflect the virtual and phantom trades.

Only exception is NumPendingTotal, which is always the number of pending

virtual and phantom trades since pool trades are never pending. 'Real'

phantom trades for the purpose of equity curve trading also contribute to the Long/Short statistics,

but won't trigger pool trades. Virtual hedging is not used for optimization

or training.

- Hedge = 5 is preferable to Hedge = 4 since

it opens fewer trades and causes less transaction costs. Hedge

= 4 is required when partial closing is not supported by the

broker or account. This is often not documented, but you can find out with the

TradeTest script. Start a session,

set Lots to 10, open a position, then set Lots to 5 and close the position.

If this fails, your account does not support partial closing.

- Hedge >= 2 enables full hedging and won't automatically close opposite positions. If this is required, do it by

script.

- The number of open net lots of pool and phantom trades can be evaluated

with the LotsPool and LotsPhantom

variables. They can temporarily be out of sync when pool trades are externally

or manually closed. They will then automatically get in sync again at the next

virtual trade with the same asset.

- Opening pool trades can be prevented by setting Lots

= 0. As long as no phantom trades are

opened or closed, pool trades won't then be opened even when

LotsPool and LotsPhantom

are different.

- Pool trades have no profit target and no TMF, but

- for protection against large price shocks - a very far stop loss at 25% distance to the current price. They are normally only controlled by opening

and closing phantom trades.

- Pool trades appear in trade enumeration loops and

can be identified by TradeIsPool.

When enumerating trades, make sure to separate them from virtual trades (if(!TradeIsPool)...

).

- Pool trades that were rejected by the broker will be re-entered at every

bar until LotsPool and LotsPhantom

are in sync again. Synchronizing can be enforced with

tradeUpdate.

- Dependent on open trades, closing a phantom trade can cause closing of several

pool trades and/or opening of a new pool trade, especially in Hedge

= 4 mode. A phantom trade can close with a loss and the subsequent

pool trade with a win, or vice versa. This is a perfectly normal consequence

of virtual hedging and not a bug.

- In virtual hedging mode, the result window displays

only open pool trades and pending phantom trades. When algo

identifiers are used, pool trades are displayed either with the identifier

of the triggering trade, or with a "NET" identifier.

- Hedging is prohibited for US based accounts due to NFA Compliance Rule 2-43(b).

Such accounts normally require the NFA

flag and either virtual or no hedging. The NFA flag does not

affect phantom trades, which can be simultaneously open in both directions.

Example:

if(Live)

Hedge = 5; // virtual hedging in trade mode

else

Hedge = 2; // full hedging in test mode

See also:

NFA, enterLong/Short,

LotsPool, Phantom trades,

tradeUpdate

►

latest version online